What’s my bar routine missing? What are the biggest deductions I’m getting?

This is a very common question for Level 6-10 bars. What’s the answer? Often, it has to do with bar angle deductions.

Angle deductions are deductions that are taken during almost every bar routine. At Level 6 and 7, the deductions taken are for the completion angle of casts and circling skills. At Level 8-10, pirouetting angles are added to the mix. Short handstands are even one of the most common deductions you’ll see among NCAA athletes!

What angle is expected?

There are different angle deductions for different types of skills. The ones I will review here include casts, clear hip circles, other circling skills, and pirouettes. And of course, there are exceptions to every rule, so I will go over those exceptions as well.

Cast Angles

Once a gymnast reaches Level 7, all casts are expected to reach the handstand position. Any cast that is not within 10° of handstand will receive a deduction. A cast that is within 20° of handstand will receive B credit with a deduction. If a cast is below 20° from vertical, it will receive NO value part credit. Also, keep in mind that the deductions listed are ONLY for amplitude, or the completion angle of the cast. Casts are also subject to execution deductions such as bent arms, leg separation, and poor body position.

Cast angles are determined by drawing an imaginary line between the gymnast’s shoulders and the lowest part of her body. If she is arched, the lowest body part is likely her belly. If she is piked, her lowest body part will be her feet. A straight body cast will show a straight line from the shoulders to the feet. If the gymnast performs a straddle cast, the angle achieved is determined by when her feet come together.

As you can see, this cast appears to be higher than it is because the gymnast’s body is slightly arched. The line between shoulders and lowest body part is NOT the same as the line from her shoulders to her feet. Always check to be sure you are looking at the line from shoulders to lowest body part when determining the angle of a cast.

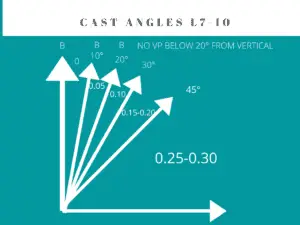

At Levels 7-10, the cast deductions are as follows:

- 0-10° from vertical: NO deduction

- 10°-20° from vertical: 0.05

- 20°-30° from vertical: 0.10

- 30°-45° from vertical: 0.15-0.20

- Below 45° from vertical: 0.25-0.30

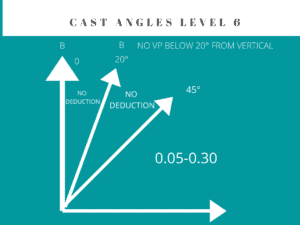

At Level 6, the casting deductions are less severe. Level 6 casts are only required to go to 45°, with the Special Requirement awarded if the cast is above horizontal. For this reason, casts are not deducted for amplitude if they reach at least 45°. The Value Part credit remains the same, with a B cast to handstand awarded for casts that are within 20° of vertical. No Value Part credit is awarded for casts below 20° from vertical at Level 6.

The Level 6 deductions are as follows:

- 0-45° from vertical: NO deduction

- Below 45° from vertical: 0.05-0.30

Note that there are NO casting angle deductions in any division of the Xcel program.

Clear Hip Circle Angles

Clear hip circles are the most common circling skill on bars, especially in the beginning optional levels. Clear hip circles have their own angle deductions, separate from other circling skills. Similar to casts, clear hip circles raise their value (from B to C) if they finish within 20° of handstand. Clear hips that finish between 20° and 45° from handstand get B credit, with no angle deduction. Below 45°, the deductions get progressively larger, with the largest deductions for clear hips that finish below horizontal.

Similar to casts, the angle of a clear hip is evaluated by looking at a straight line between the shoulders and the lowest body part. The angle is evaluated when the gymnast shifts her wrists to the top of the bar. If the gymnast shifts her wrists very late, she will likely get the maximum angle deduction for her clear hip.

The only exception to these deductions is in the Xcel levels. Xcel Bronze and Silver are not allowed to perform clear hip circles. At the Gold division, clear hip circles are allowed, but with NO amplitude deductions. (Execution deductions such as bent arms and arched body still apply.) At the Platinum and Diamond divisions, clear hip circles are subject to the same deductions used in the J.O. levels.

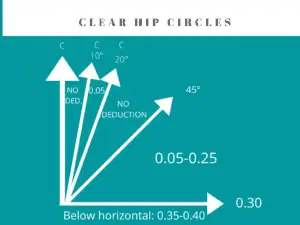

The clear hip circle angle deductions are as follows:

- 0-10° from vertical: NO deduction, award C VP

- 11°-20° from vertical: 0.05, award C VP

- 21°-45° from vertical: NO deduction, award B VP

- 46°-horizontal: 0.05-25, award B VP

- Below horizontal: 0.35-0.40, award B VP

Other Circling Skills

All circling skills besides clear hip circles have the same set of deductions. These circling skills include stalders, Endos, sole circles, clear pike circles (in-bar skills), and Weiler kips. Click on each skill name to see a video of the skill.

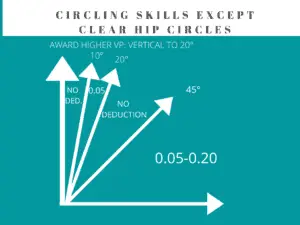

The angle deductions for circling skills are smaller than the deductions for clear hip circles, with a maximum deduction of 0.20. These deductions are:

- 0-10° from vertical: NO deduction, Award higher VP

- 11°-20° from vertical: 0.05, Award higher VP

- 21°-45° from vertical: NO deduction, Award lower VP

- 46° from vertical and below: 0.05-0.20, Award lower VP

The 20° completion angle is also used for completion of giant circles and front giants. For instance, if a gymnast falls off the bar on a giant, the judges will evaluate the angle she achieved before the fall. If she completes the giant within 20° of handstand, she will receive B credit despite the fall. If she does not finish within 20°, she will receive no VP credit for the attempt. Coaches can use this information to make an educated decision on whether to have the gymnast repeat the giant after the fall – assuming she’s normally consistent with the skill and isn’t too tired to complete it on the second try!

Pirouettes and Flights to Handstand

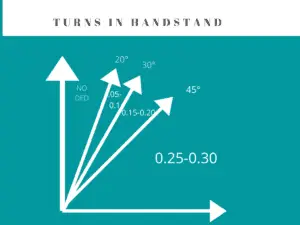

The final category of angle deductions is for pirouetting skills and flights to handstand. There are two types of pirouetting skills, each with a different set of deductions. The first type of skill is a turn in handstand, such as a handstand 1/2 pirouette, or a giant-full (blind-full). There is no deduction for turns in handstand that finish within 20° of handstand, and the largest deductions are for turns that finish past 45 degrees. The angle of completion is evaluated when the second hand contacts the bar at the end of the turn.

Deductions for turns in handstand:

- 0-20° from handstand: NO deduction

- 21°-30° from handstand: 0.05-0.10

- 31°-45° from handstand: 0.15-0.20

- 46° from handstand or below: 0.25-0.30

For all turns in handstand that go over the bar, the value remains the same regardless of the angle of turn completion. For turns that do not go over the bar, such as a giant 1/2, swing down on the same side, the gymnast MUST finish within 20° of handstand to receive Value Part credit for the skill. Using the example of the giant 1/2, if the gymnast completes the turn below 20° but above 45°, she would receive B Value Part credit for a swing 1/2 turn above 45°. Below 45°, she would receive no Value Part credit.

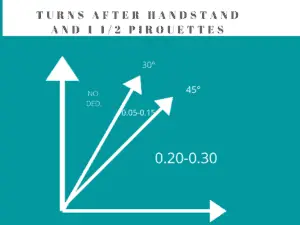

The second type of pirouetting skill is a turn after handstand, such as a blind change or Higgins. All 1 1/2 pirouettes are also included in this category. There is more room for error in the deductions for turns after handstand, due to the technique required to complete these turns. For turns after handstand, there is no angle deduction if the turn finished within 30° of handstand. The pirouette angle is complete when the hand contacts the bar.

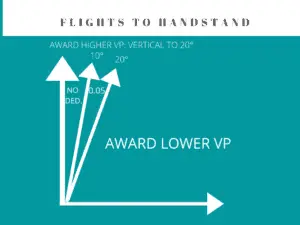

Finally, there are angle deductions that can be applied for flight skills that land in handstand on the low bar. Examples of these skills are straddle back to handstand and bail to handstand. These skills are expected to finish within 20° of handstand to receive no deduction. If they do not finish within 20° of handstand, the lower Value Part would be given.

Deductions for flights to handstand:

- 0-10° from handstand: NO deduction, Award higher VP

- 11°-20° from handstand: 0.05, Award higher VP

- 21° from handstand or below: NO angle deduction, Award lower VP

Exceptions

Of course, there are exceptions to every rule, and there are several situations in which angle deductions are not taken. Here they are, in no particular order.

- There are no cast angle deductions in any Xcel division.

- In the Gold division of Xcel, there are no angle deductions for clear hip circles. Clear hip angle deductions resume for the Platinum and Diamond divisions.

- At Levels 7 and 8, there is no angle deduction for a cast before a bail to low bar.

- At Levels 6, 7, and 8, clear hips between 45° and vertical receive no angle deduction and count as a B.

Angle deductions can be confusing, as there are so many different scenarios and rules to apply. What challenges do you have with angles on bars? Look for videos to come soon, to further explain these deductions!